Chipotle’s Business Model and Performance: Chipotle Stock

Chipotle Mexican Grill has carved a niche in the fast-casual dining industry with its unique business model that emphasizes fresh ingredients, customization, and a limited menu. This approach has propelled the company to significant growth and profitability, but it has also faced challenges in recent years.

Chipotle’s Business Model

Chipotle’s business model revolves around offering customizable, fresh, and high-quality food at a reasonable price. The company’s core menu consists of burritos, bowls, salads, and tacos, all made with fresh ingredients, including organic and locally sourced options whenever possible. Customers can choose from a variety of proteins, toppings, and sauces to create their own personalized meal. This customization aspect allows Chipotle to cater to a wide range of dietary preferences and tastes.

Chipotle’s focus on fresh ingredients and a limited menu also allows for operational efficiency. By minimizing the number of menu items, the company can streamline its supply chain and reduce waste. This approach also helps to ensure the quality and consistency of its food.

Chipotle’s Financial Performance

Chipotle has consistently delivered strong financial performance in recent years. The company’s revenue has grown steadily, driven by increased store count and same-store sales growth. In 2022, Chipotle’s revenue reached $8.6 billion, representing a significant increase from $6.0 billion in 2019.

Key Performance Metrics

- Revenue Growth: Chipotle’s revenue has grown at a compound annual growth rate (CAGR) of approximately 12% over the past five years. This growth has been driven by a combination of new store openings and same-store sales growth.

- Same-Store Sales: Chipotle’s same-store sales have also been consistently strong, reflecting the company’s popularity and customer loyalty. In 2022, same-store sales increased by 10.1%, demonstrating the continued demand for Chipotle’s offerings.

- Profitability: Chipotle’s profitability has been impressive, with the company consistently generating strong margins. In 2022, Chipotle’s operating margin was 17.8%, highlighting its ability to control costs and drive efficiency.

Chipotle’s Performance Compared to Competitors

Chipotle faces competition from a wide range of players in the fast-casual dining industry, including:

- Qdoba Mexican Eats: Qdoba is a direct competitor to Chipotle, offering a similar menu of customizable Mexican-inspired dishes.

- Moe’s Southwest Grill: Moe’s is another fast-casual chain that focuses on customizable burritos, bowls, and tacos.

- Panera Bread: While Panera offers a wider range of menu items, including soups, salads, and sandwiches, it competes with Chipotle for the same customer base.

Chipotle has a strong track record of outperforming its competitors in terms of revenue growth, profitability, and customer satisfaction. The company’s focus on fresh ingredients, customization, and a limited menu has helped it to differentiate itself from its rivals. However, Chipotle also faces some challenges, such as rising food costs and competition from other fast-casual chains.

Chipotle’s Strengths and Weaknesses

Strengths

- Brand Recognition: Chipotle has built a strong brand reputation for its fresh, high-quality ingredients and customizable menu.

- Loyal Customer Base: The company has a loyal customer base that appreciates its commitment to fresh food and its unique dining experience.

- Strong Financial Performance: Chipotle has consistently delivered strong financial performance, with robust revenue growth and profitability.

- Innovation: Chipotle is constantly innovating its menu and offerings, introducing new items and flavors to keep its customers engaged.

Weaknesses

- Food Safety Issues: Chipotle has faced several food safety challenges in recent years, which have hurt its reputation and sales.

- Rising Food Costs: The company is exposed to rising food costs, which can impact its profitability.

- Competition: Chipotle faces intense competition from other fast-casual chains, which are constantly vying for market share.

- Limited Menu: While Chipotle’s focus on a limited menu allows for operational efficiency, it can also limit its appeal to customers who prefer a wider variety of options.

Chipotle’s Growth Strategy and Expansion

Chipotle’s growth strategy is focused on expanding its footprint, enhancing its digital capabilities, and refining its menu offerings. The company aims to achieve this through a combination of new store openings, menu innovation, and digital initiatives.

Expansion Strategy

Chipotle’s expansion strategy is driven by its commitment to opening new restaurants in both existing and new markets. This includes opening more restaurants in urban areas, suburban areas, and even rural areas. The company also plans to expand its international presence, particularly in countries with a strong demand for fast-casual dining.

Menu Innovation

Chipotle’s menu innovation strategy focuses on introducing new menu items that cater to evolving consumer preferences. The company has introduced new menu items such as cauliflower rice, chorizo, and plant-based meat alternatives. The company also plans to continue to explore new flavors and ingredients to cater to a wider range of consumers.

Digital Initiatives

Chipotle’s digital initiatives are focused on enhancing the customer experience and increasing convenience. The company has invested heavily in its online ordering and delivery platforms, allowing customers to order food online and have it delivered to their homes or offices. The company also offers a mobile app that allows customers to order food, track their orders, and earn rewards.

Impact of Expansion, Chipotle stock

Chipotle’s expansion into new markets and its efforts to increase international presence have the potential to significantly increase its revenue and customer base. The company’s expansion strategy is likely to lead to increased competition in the fast-casual dining market, particularly in new markets. However, Chipotle’s strong brand recognition and its commitment to high-quality ingredients are likely to give it a competitive advantage.

Challenges and Opportunities

Chipotle’s growth strategy is not without its challenges. The company faces challenges such as increasing labor costs, supply chain disruptions, and competition from other fast-casual dining restaurants. However, Chipotle also has opportunities for growth. The company can leverage its strong brand recognition, its commitment to high-quality ingredients, and its digital initiatives to continue to grow its business.

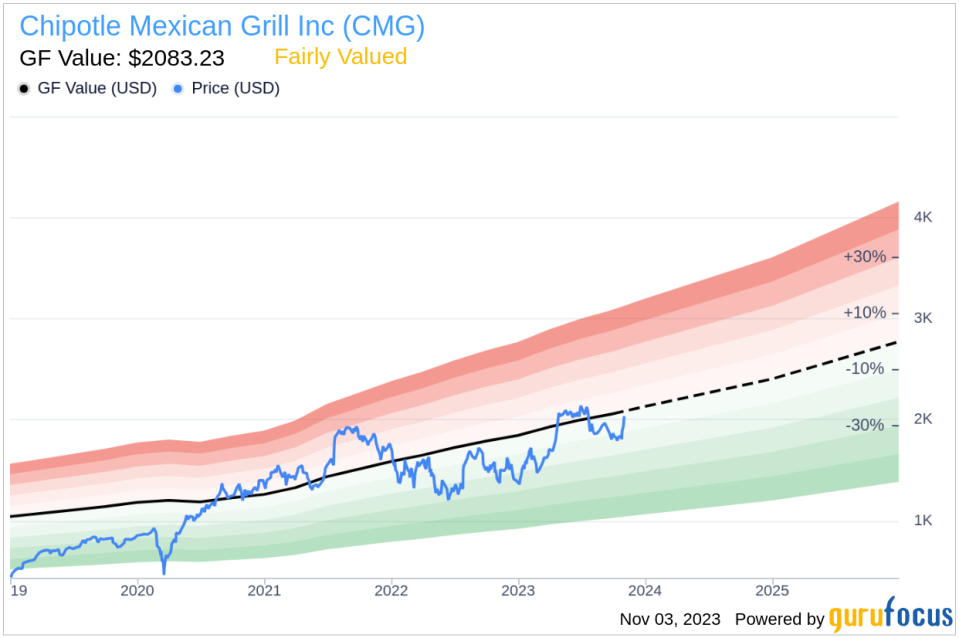

Key Factors Influencing Chipotle’s Stock Price

Chipotle Mexican Grill’s stock price is influenced by a complex interplay of economic, industry, and company-specific factors. Understanding these factors is crucial for investors seeking to assess the company’s future prospects and make informed investment decisions.

Economic and Industry Factors

Economic conditions significantly impact consumer spending, which directly affects Chipotle’s sales. For example, during periods of economic recession, consumers may cut back on discretionary spending, including dining out, which could negatively impact Chipotle’s revenue. Inflation also plays a role, as rising food prices can force Chipotle to raise menu prices, potentially affecting customer demand. The company’s reliance on fresh ingredients exposes it to fluctuations in food commodity prices, which can impact its profitability.

Operational Performance

Chipotle’s stock price is also closely tied to its operational performance. Same-store sales growth is a key indicator of the company’s ability to attract and retain customers. Consistent same-store sales growth indicates strong customer demand and efficient operations. Margins, which reflect the company’s profitability, are another important factor. Higher margins suggest efficient cost management and pricing strategies. Customer satisfaction is also critical, as it influences brand loyalty and repeat business.

Investor Sentiment and Market Trends

Investor sentiment towards Chipotle can significantly influence its stock price. Positive sentiment, fueled by strong financial performance, innovative menu offerings, and positive media coverage, can drive up the stock price. Conversely, negative sentiment, driven by factors such as food safety concerns, labor shortages, or disappointing financial results, can lead to a decline in the stock price. Market trends, such as the overall performance of the restaurant industry or investor appetite for growth stocks, also play a role in shaping Chipotle’s stock price.

Chipotle stock, man, it’s like a rollercoaster ride. You never know if you’re gonna be soaring high or plummeting to the ground. But hey, if you’re looking for a comparison, check out starbucks chipotle – those guys are pretty much in the same boat.

Both are trying to navigate this crazy market, dealing with inflation and all that jazz. So yeah, Chipotle stock – it’s a gamble, but hey, who doesn’t love a good gamble, right?

Chipotle stock, man, it’s like that one friend who always seems to be on the rise. You know, the one who’s always got the latest tech gadgets and is always talking about their big plans. But sometimes, you wonder if it’s all hype.

That’s where you gotta check out cmg stock , the real deal, the ticker symbol behind all the Chipotle buzz. It’s like peeking behind the curtain, seeing what’s really driving that burrito empire. So, if you’re thinking about investing in Chipotle, you gotta do your research, man.

Don’t just go by the hype, dig deeper.