Market Performance Analysis: Hims Stock

The stock price of Hims & Hers Health, Inc. (HIMS) has experienced significant volatility in recent months. The stock price initially surged after the company’s initial public offering (IPO) in February 2021, reaching a high of $30.22 in February 2022. However, the stock price has since declined, and as of March 2023, it is trading at around $6.50.

Several factors have influenced the stock’s performance. These include the company’s financial performance, the competitive landscape, and the overall market conditions.

Financial Performance

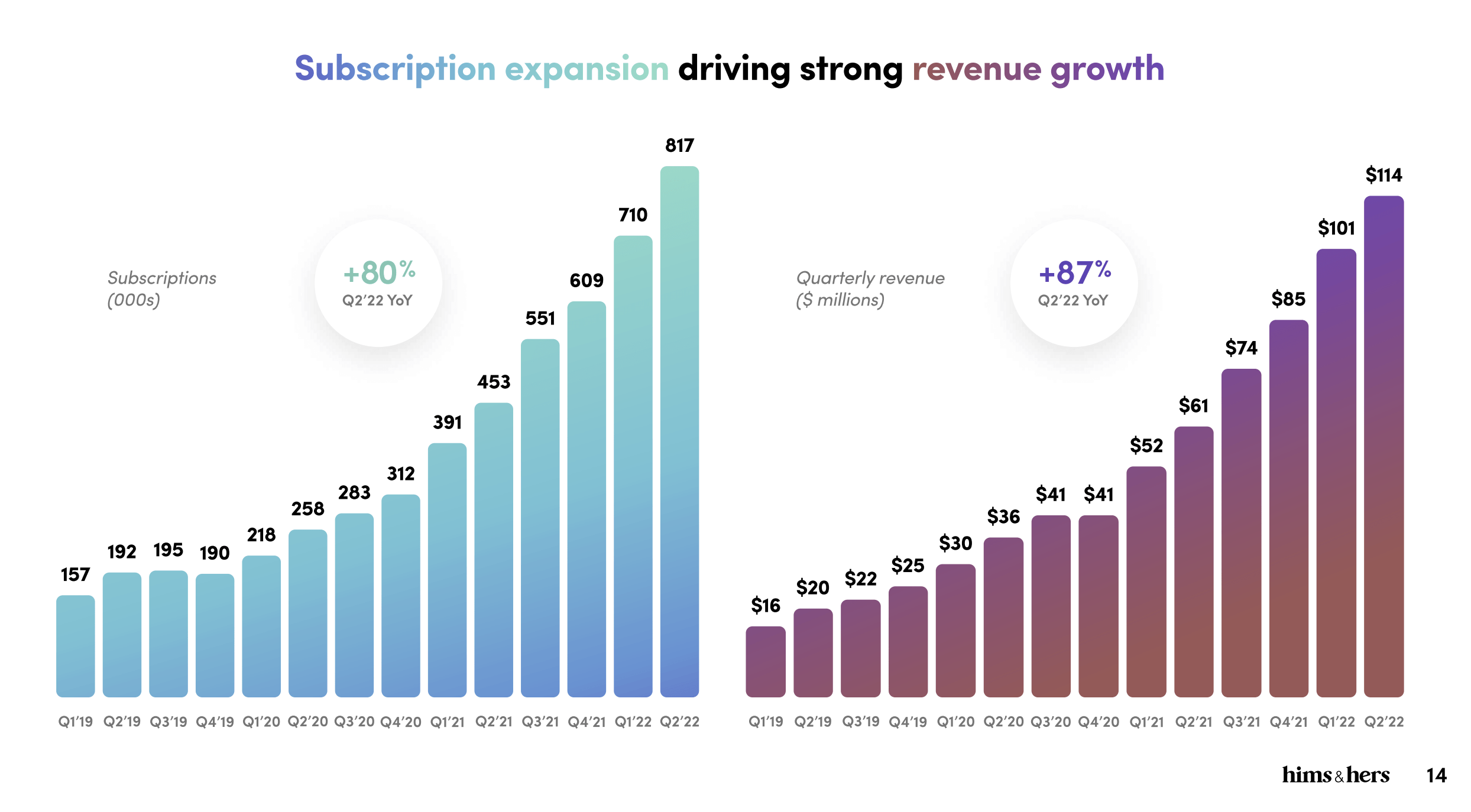

Hims & Hers Health has reported strong revenue growth in recent quarters. In the third quarter of 2022, the company reported revenue of $108.5 million, an increase of 91% year-over-year. However, the company has also reported widening losses. In the third quarter of 2022, the company reported a net loss of $44.3 million, compared to a net loss of $22.5 million in the third quarter of 2021.

Competitive Landscape

Hims & Hers Health operates in a competitive market. The company faces competition from other telehealth companies, as well as from traditional healthcare providers. The company’s ability to compete effectively will be a key factor in its future success.

Overall Market Conditions, Hims stock

The overall market conditions have also impacted the stock price of Hims & Hers Health. The stock market has been volatile in recent months, and this volatility has impacted the stock prices of many companies, including Hims & Hers Health.

Business Model and Growth Strategy

Hims stock – Hims & Hers Health, Inc. (HIMS) is a telehealth company that provides personalized health and wellness products and services to consumers.

The company’s business model is based on a subscription-based service, where members pay a monthly fee to access a range of services, including virtual doctor visits, prescription medications, and personalized health and wellness products.

Growth Strategy

HIMS’s growth strategy is focused on expanding its product and service offerings, increasing its member base, and entering new markets.

The company is also investing in technology and data analytics to improve its customer experience and develop new products and services.

Competitive Advantages

- Strong brand recognition

- Subscription-based model provides recurring revenue

- Focus on personalized health and wellness

- Technology and data analytics capabilities

Challenges

- Competition from other telehealth companies

- Reimbursement challenges

- Regulatory compliance

- Patient acquisition and retention

Industry Trends and Future Outlook

The telehealth industry is experiencing significant growth, driven by advancements in technology and changing healthcare consumer preferences. Key trends include the rise of virtual care, increased use of mobile health apps, and the integration of telehealth into traditional healthcare settings.

Regulatory changes are also shaping the telehealth industry. In the United States, the relaxation of regulations during the COVID-19 pandemic has led to increased adoption of telehealth services. However, as the pandemic subsides, it remains to be seen whether these relaxed regulations will become permanent.

Future Prospects of Hims & Hers Health, Inc.

Hims & Hers Health, Inc. is well-positioned to benefit from the continued growth of the telehealth industry. The company has a strong brand presence, a wide range of services, and a growing customer base. Hims & Hers is also investing heavily in technology and innovation, which will help it to stay ahead of the competition.

Overall, the future prospects for Hims & Hers Health, Inc. are positive. The company is well-positioned to capitalize on the growth of the telehealth industry and continue to expand its market share.

Hims stock has seen a recent surge in interest, with many investors looking to capitalize on its growth potential. While the company’s products have gained popularity, it’s worth noting that the market for personalized items like pa license plates is also experiencing strong growth.

This suggests that Hims stock may be well-positioned to benefit from both its own product offerings and the broader trend towards customization.

Hims stock is a hot topic among investors, and for good reason. The company has a strong track record of growth and profitability, and its products are in high demand. If you’re looking for a way to invest in the future of healthcare, Hims stock is a great option.

And if you’re looking for a way to personalize your car, you might want to consider getting a pa vanity plate. Vanity plates are a great way to show off your personality, and they can also be a valuable investment.

Hims stock is a great way to invest in your future, and a vanity plate is a great way to invest in your car.